Sottotitolo:

The Greek case of public spending deficit is totally different from the Irish crisis characterized by debt of private banks, but the unfortunate policy of the euro-zone has the same devastating effect.

The philosophy of the Maastricht Treaty was absolutely clear: the only threat to the economic stability could come from public budget deficits of member countries, where politicians run as free riders to take advantage from the participation to the common currency. For this reason the Treaty established the independence of ECB, the “no bail-out clause” and a Stability Pact was added to the excess deficits articles. For the same reason there was no need of having a European Fund able to deal with a situation of liquidity or insolvency crisis.

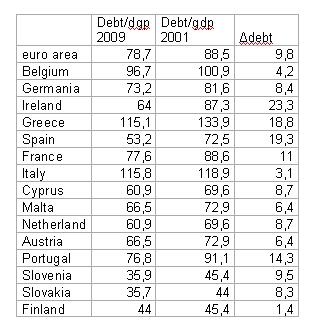

Things went in a different way: the crisis originated from excess debt and risk led by banks and other financial institutions; the epicentre was in US, but European banks participated willingly to this new version of “Ponzi game”, in particular British and Irish banks. Beginning with 2008 and mainly in 2009 public debt rose almost everywhere; considering fifteen euro countries inTable1 one can see how the crisis caused an increase in public debts, with a tendency of those countries with a lower level in 2007 to increase the debt much than the other countries (table.1).

| Tab.1

Data from Eurostat |

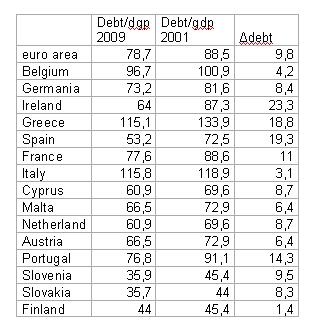

Tab.2

Data from Eurostat |

Broadly speaking the automatic stabilizers did their work, but there were also Keynesian budget policies and bail-out interventions to save the banking system. In 2010 things changed quickly, as one can see in Table II, with the estimate debts in 2011 (Table 2).

Looking at Table II we can see that the negative correlation between debt variation and debt level shown in Table I disappears : every country is aiming at stopping the debt growth and Gips countries have the greatest increase. The Greek case of deficit spending (and hiding) has been seen as a proof of the German view on sound budget policy, needed in order to restore good conditions for a sustainable economic growth. But the Irish case is just the opposite: until 2007 the Celtic tiger was the greatest success among the European economies ; now Financial Times writes (February 28) that “the devastation that last Friday’s Irish election brought to Fianna Fail was almost as complete as the destruction that banks and real estate developers inflicted on the country on that party’s watch”.

More than one year ago concerns over debt sustainability in Greece began spilling out to the so called peripheral countries of Eurozone, with a dramatic increase in interest spread over German bonds and in the level of Credit default swops. Lending from EU and IMF to Greece, and then to Ireland from the European Financial Stability Facility (EFSF), did not convince financial markets, which think that Greece in particular, but Gips countries in general, have a problem of sustainability.

Recently researchers from Bruegel think-tank calculated the primary surplus needed to stop the debt growth from 2015 onwards for Gips countries, supposing i) lowering of the interest rate on all official EU loans, ii) extending maturity on EU and IMF loans, iii) repurchasing by EFSF of all sovereign bonds held by ECB at market value with a retrocession of the corresponding haircut to the issuing country . With these three measures, good optimism in the evolution of rates of interest and growth, and with a positive reaction from financial markets (lowering of 100 points of the spread on bonds) Gips countries may be save, even if Ireland and Greece should reach very high primary surpluses (10% and 8% respectively). Without measures, optimism, and positive reaction Greece and Ireland would become insolvent, and also Portugal and Spain would find itself in deep waters .

Very likely the proposals from Bruegel researchers are shared by many economists, not surely from 189 German economists who signed a call on the German government to force Gips into an insolvency procedure (see Mario Nuti). Actually they agree that without lowering interest rates, extending maturity and applying an haircut things will fall down, but they think that the punishment is necessary to avoid repeating the mistakes. After the declaration of state of insolvency, an adequate penance is required so that eventually EU could say “go and sin no more”. This kind of statements are popular in Germany, except among German bankers.

Recently (5 march) Klaus Regling (president of EFSF), talking to Austrian radio, said that he doesn’t foresee new demands for help by Gips countries, that the financial markets are wrong , that there is no need for EFSF to buy the bonds bought by ECB. The problem is that of avoiding, at the next European meeting, any agreement which could sound like a “TransferUnion” that is a EU in which richer countries finance poorer ones, is still dominant in Germany (and other Nordic countries). What is missing is a consideration about the way in which the birth of euro represented a perfect fixed exchange rate regime, from which German get good benefits. Even the sovereign debt crisis prevented last year a strong revaluation of euro, not bad for an export-let country.