Institutes |

Small and big European countries in front of the crisis

Sottotitolo:

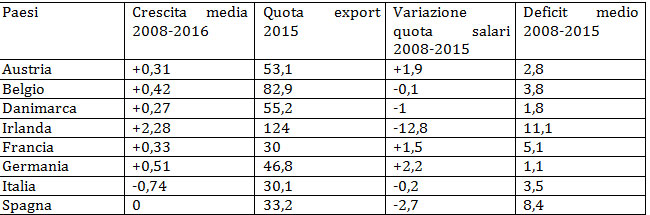

Comparing the four small countries with the four largest countries in the euro zone, with reference to the eight years following the financial crisis. Ozlem Onaran and Thomas Obst, two researchers at Greenwich Political Economy Research Centre and FEPS (Foundation for European Progressive Studies), have made an econometric study, entitled: Wage-led growth in the EU 15 Member States; the study considers over a period of more than fifty years (1960-2013). They summarize in this way the results: " This paper estimates a multi-country demand-led growth model for EU15 countries. A decrease in the share of wages in national income in isolation leads to lower growth in Finland, France, Germany, Greece, Italy, Luxembourg, Netherlands, Portugal, Spain, Sweden and the United Kingdom, whereas it stimulates growth in Austria, Belgium, Denmark and Ireland”. Table I The phenomenon described by Onaran and Obst is clearly visible in the case of Ireland, and, in more attenuated way, in the case of Spain. The fall of the Irish wage share is impressive, as is the export quota, rising in seven years of 28.8 percentage points. In the Spanish case (export share + 7.9%) one can note that wage compression was balanced by a very high average deficit; the Irish one is even longer, but went mainly to support banks, rather than to support families. Note that all countries, except Austria, where it has remained almost constant, have increased the share of exports, as seen in Table 2

In this case there isn’t a relationship between the decrease of wage shares and the increase in exports; as we see Germany and France, Belgium and Italy have had similar increases even though in the first two countries the wage share increased, while in the other two countries fell slightly. For these four countries, the common phenomenon was the compression of domestic demand, as a result of austerity policies which have prompted firms to try to increase sales abroad, resulting in increased export quota. Ruggero Paladini

Economist - Professor of "Scienza delle Finanze" at University "La Sapienza" Roma; Member of the Economic Board of Insight - ruggero.paladini@uniroma1.it |